Barely mentioned in the 2035 strategy, absent from the Tounes Wijhetouna program (an absence assumed by the program’s managers), the business tourism sector, and more specifically the corporate events sector, is nonetheless one of the most profitable in Tunisian tourism. It is also one of the most promising, accounting for 1/3 of the country’s tourism revenue (WTTC estimate). But it suffers from a lack of knowledge that could hinder its development.

Photo: Odyssée Resort & Thalasso, Zarzis

We’ve all heard this definitive judgment from tourism leaders or observers: “To develop the MICE sector, we need to create a large-capacity convention center in each of our regions”.

Given that such investment is unlikely to be among the priorities of public or private investors, this statement sounds like a condemnation to stagnation for the MICE (Meetings, Incentives, Congresses & Exhibitions/Events) sector.

Yet recent studies (such as the Fortune Business Insights study) confirm the sector’s weight: $970 billion by 2024, or more than half of international tourism. They also confirm the sector’s growth potential: nearly 9% per year between now and 2032.

Meetings and incentives first

Above all, these studies confirm the importance of meetings and incentives, at the expense of conventions and congresses. Together, they account for over 2/3 of the market. And the number of participants in each meeting rarely exceeds 300.

In all, Tunisia’s various regions boast some 80 hotel meeting rooms with a capacity of 400 people or more.

-

See our table at the end of the article: Meeting rooms integrated into hotels.

In France, a recent study (Coach Omnium) concludes that in 2023, “meetings with more than 200 participants are infrequent”.

THE MICE MARKET IN FRANCE IN 2023

Average number of participants in meetings of all sizes (multiple answers possible)

Etude : Coach Omnium et 1001 Salles

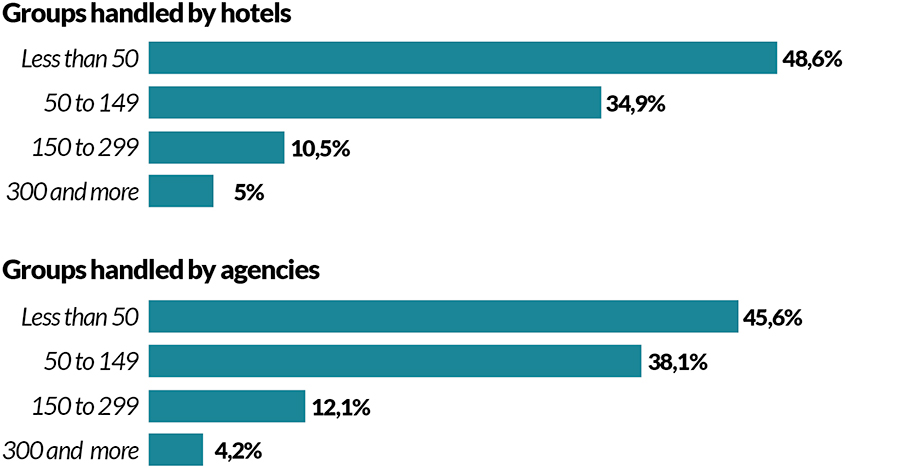

Similarly, in Tunisia, a survey of professionals carried out by the Tunisia Convention Bureau in 2023 concludes that groups of less than 150 people account for over 80% of the business handled.

THE MICE MARKET IN TUNISIA IN 2023

Group size: number of participants (meetings and incentives combined)

Tunisia Convention Bureau survey of 50 hotels and 20 specialized agencies

Tunisia’s advantages for meetings

New hotel investments in Tunisia are following this trend. These include the Kyriad Prestige in Tunis (5 modular rooms, including one for 150 people), the Mariott Tunis (240 people in the largest room) and the recent center at The Sindbad hotel in Hammamet (maximum capacity 200 people).

Meeting rooms at the Kyriad Prestige, Tunis

So it’s clear that with its current infrastructure, which remains under-exploited outside Tunis, our destination can position itself in the meetings segment. In addition to incentives, for which it has undeniable assets – not least the know-how of Tunisian professionals.

The Exhibitions/Events segment, on the other hand, remains out of our reach and the preserve of a few major international groups such as Reed Exhibitions (which operates in countries on five continents, including France with Top Resa and Dubai with Arabian Travel Market).

Solutions for major conventions

It therefore seems appropriate to focus any MICE strategy on the Meetings and Incentives segments.

Such a strategy need not exclude major conventions. While it’s true that our destination is not a favorite in the market for major conventions and congresses, it can, with its current resources, adopt an outsider’s strategy and attract certain events, as it has done in the past. The holding of the Francophonie Summit in Djerba, despite the circumspection of a good number of observers, is there to remind us of this.

The example of this summit could lead us to believe that MICE is dependent on government decisions. However, as a study by GM Insights shows, governments are responsible for only a small third of events.

In addition to the convention centers in Tunis (Palais des Congrès, 900 seats) and Hammamet (2,000 seats), the Pasino in Djerba (1,500 seats) and some hotel rooms boast capacities worthy of a convention center: 1,200 at the Radisson Blu Hotel & Convention Center (ex-Laico Tunis), 1,500 at the Grand Hôtel (Ariana), 1,500 at the Regency (under tent, plus a 600-person room), 1,000 at the Mahdia Palace and as many at the adjoining Nour Palace, 900 at the Nour Congress Hotel in Bizerte, 1,200 at the El Mouradi convention center in Port El Kantaoui.

Lotfi Mansour

Table: Meeting rooms integrated into hotels

Capacity of 400 or more (theater)

| Hotel | Category (stars) |

Capacity |

| Tunis | ||

| Grand Hôtel | 5 | 1,500 |

| Radisson Blu Hotel & Convention Center | 5 | 1,200 |

| Mövenpick Tunis Hotel du Lac | 5 | 700 |

| Royal Asbu | 5 | 650 |

| Acropole | 4 | 600 |

| Golden Tulip El Mechtel | 4 | 450 |

| Majestic Hotel | 4 | 400 |

| Sheraton Tunis | 5 | 400 |

| Gammarth/ La Marsa | ||

| Golden Carthage | 5 | 800 |

| El Mouradi Gammarth | 5 | 700 |

| Regency Tunis Hotel | 5 | 600 |

| Four Seasons | 5 | 440 |

| Hammamet/ Nabeul | ||

| Palais des Congrès Medina (2 hotels) | x | 2,000 |

| Sol Azur | 4 | 700 |

| Le Royal | 5 | 600 |

| Nahrawess | 4 | 600 |

| Vincci Saphir Palace | 5 | 500 |

| El Mouradi Hammamet | 5 | 500 |

| El Mouradi El Menzah | 4 | 500 |

| Laico Hammamet | 5 | 460 |

| TUI Blue Oceana | 5 | 450 |

| Royal Tulip Taj Soltan | 5 | 420 |

| Iberostar Waves Averroes | 4 | 400 |

| Le Sultan | 4 | 400 |

| Occidental Marco Polo | 4 | 400 |

| Sousse/ Port El Kantaoui | ||

| El Mouradi Club Kantaoui (Congress Center) | 4 | 1,200 |

| Sousse Palace | 4 | 1,000 |

| Riviera | 4 | 750 |

| El Mouradi Palace | 5 | 750 |

| Mövenpick Resort | 5 | 629 |

| Houria Palace | 4 | 500 |

| El Mouradi Palm Marina | 4 | 450 |

| Barcelo Concorde Green Park | 5 | 400 |

| Monastir | ||

| Amir Palace | 5 | 1,000 |

| El Mouradi Skanes | 4 | 500 |

| Hilton Skanes | 5 | 411 |

| Royal Thalassa | 5 | 400 |

| Mahdia | ||

| Nour Palace | 5 | 1,100 |

| Mahdia Palace | 5 | 1,000 |

| El Mouradi Mahdia | 5 | 600 |

| Iberostar Selection Royal Mansour | 5 | 480 |

| Djerba-Zarzis | ||

| Djerba Resort | 4 | 750 |

| Odyssée Resort | 4 | 600 |

| El Mouradi Djerba Menzel | 4 | 600 |

| Djerba Plaza | 4 | 500 |

| Radisson Blu Palace | 5 | 400 |

| Ulysse Palace | 5 | 400 |

| Hasdrubal Prestige | 5 | 400 |

| Palm Beach Palace | 5 | 400 |

| Bizerte | ||

| Nour Congress | 4 | 900 |

| Bizerta Resort | 4 | 550 |

| Sfax | ||

| Concorde Occidental Sfax Center | 4 | 800 |

| Les Oliviers Palace | 5 | 600 |

Table © Touriscope/MCM – Non-exhaustive list